First Circle Financial offers the public an opportunity to invest in diversified mortgage portfolios through its mortgage funds. Each fund is a Mortgage Investment Corporation or ‘MIC’ as defined by Section 130.1 of the Income Tax Act (Canada).

MICs are companies organized to allow individuals to invest in a pool of diversified and secured mortgages. Earnings are distributed quarterly by way of dividends, but are treated in the hands of the shareholders as interest income. Provided the company maintains its status as a MIC, it will pay no corporate income tax on normal revenues.

Shares of a MIC are qualified investments under the Income Tax Act for RRSPs, RRIFs, RESPs, and TFSAs. Because of the tax flow-through characteristics, purchasing Mortgage Investment Corporation shares is an excellent choice for retirement savings; they provide a steady and stable investment, plus a superior yield to most interest-bearing investment options.

First Circle Financial was established in 1991 by Alan Cross with the corporate objective to excel in the fields of mortgage portfolio management and mortgage banking. Shortly after incorporation, the company obtained a contract to manage the operations of Pacific Coast Mortgage Investment Corporation. In 2005 First Circle Financial elected to resign as manager of Pacific Coast MIC and moved to incorporate First Circle Mortgage Investment Corporation.

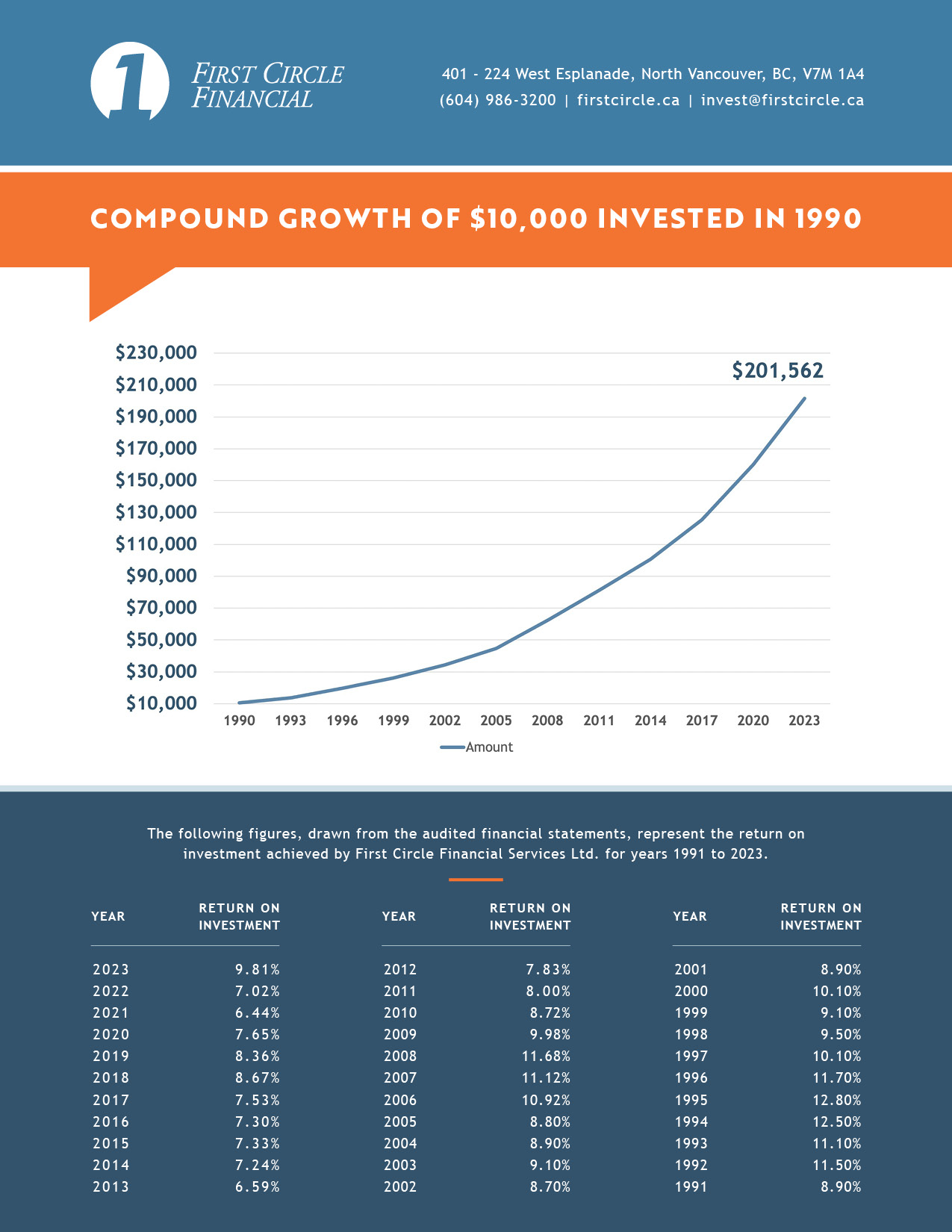

Over the past thirty years of portfolio management, despite several real estate market corrections, First Circle Financial has delivered balanced and reliable returns to its investors. As of December 31, 2023, we have almost $235 million in assets under management.

First Circle Mortgage Investment Corporation, our premier fund, invests primarily in good quality residential first mortgages and residential construction draw mortgages.

Our secondary fund, Crown Vista Mortgage Investment Corporation, was launched in the fall of 2014 with the intention of focusing on higher yielding second mortgages.

Both funds lend into major population areas of Southwestern British Columbia. Annual results for both are verified by an independent auditor, MNP LLP.

Summary

- Diversified mortgage portfolio investment opportunity

- Over twenty-five years of professional and experienced management

- Tax flow-through vehicle

- RRSP, RRIF, RESP, TFSA eligible

- Audited financial statements

First Circle Financial is a proud member of the British Columbia MIC Managers Association (BCMMA), a not-for-profit organization founded by Mr. Cross in 2010. The purpose of the BCMMA is to: facilitate the exchange of information and ideas with the goal of assisting members in the management of their organizations, present a common voice to regulators and others in an effort to protect the members’ interests and further an understanding of the MIC industry, and set and uphold industry standards for ethics and professionalism. Member candidates are considered for membership provided they meet all of the following criteria: their primary source of income is derived from managing a Mortgage Investment Corporation, the MIC under management has a minimum of $10 million in shareholder capital, the head office is situated in British Columbia, and they conduct business in an ethical, professional, and respectful manner.

*Past performance does not indicate or guarantee future results.