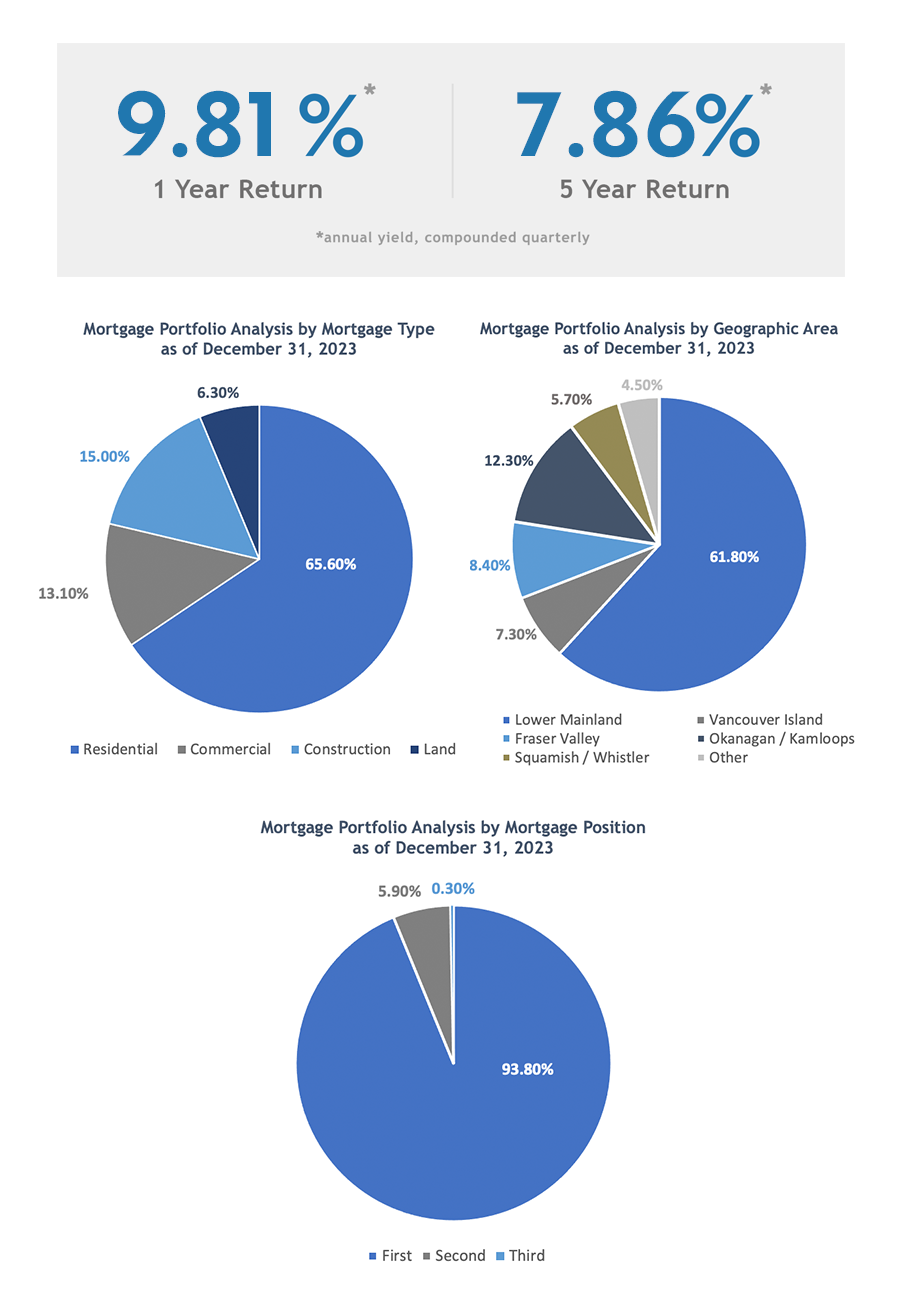

Established in 2005, our flagship fund, First Circle Mortgage Investment Corporation, invests primarily in good quality residential first mortgages secured upon properties situated throughout Southwestern British Columbia. First Circle MIC’s lending policy is that the loan amount shall never exceed 75% of the appraised value of the secured property. As of December 31, 2023 the mortgage portfolio stands at $202 million, consisting of 266 mortgages and having an average loan to property value ratio of 54%.

First Circle Mortgage Investment Corporation has a professional and experienced management team and is governed by a Board of Directors with extensive industry experience. On a quarterly basis, management prepares a report to shareholders detailing the fund’s performance and a corresponding dividend is distributed. Annual financial reports are produced in accordance with International Financial Reporting Standards (IFRS) and the company undergoes an annual review by the firm’s independent auditors, MNP LLP.

Because of the tax flow-through characteristics of MICs, purchasing preferred shares of First Circle Mortgage Investment Corporation is an excellent option for retirement savings. They provide a steady and stable investment plus a superior yield to most interest-bearing investment options. Preferred Shares of First Circle Mortgage Investment Corporation can be purchased through Self-Directed RRSPs, RRIFs, RESPs, and TFSAs. We are happy to assist investors with setting up a Self-Directed plan with one of our approved trustees. Preferred Shares of First Circle Mortgage Investment Corporation are also an excellent option for investors seeking a stable and reliable stream of income from their invested funds.

Due to new regulations put in place by the British Columbia Securities Commission (BCSC) in February 2020, Mortgage Investment Entities such as First Circle MIC are no longer able to sell shares directly to the public. Our industry is now obligated to use the services of Exempt Market Dealers (EMDs) to raise capital. EMDs are companies registered with the BCSC and authorized to trade in exempt market products, such as MIC preferred shares. They are thus deemed fit to ascertain whether investing in First Circle MIC is suitable for a potential investor.

We have partnered up with Silver Maple Ventures dba FrontFundr in this regard.

To invest in First Circle MIC, please visit the campaign page here.

- Click the green invest button and complete the Sign Up process to set up an Account.

- Complete the questionnaire and submit the requested identity verification documents.

- Complete the investment steps.

- After the investment order is submitted, the EMD will perform the suitability assessment and may contact the investor with any additional questions.

- If the transaction is approved, the Subscription Agreement will then be emailed to the client for electronic signature via HELLOSIGN.

- The investment is considered completed once First Circle MIC receives the signed documents and funds. The investment sum will start earning interest from the date it is deposited in First Circle MIC’s bank account.

Please reach out to us with any questions: [email protected] or 604-986-3200.

Summary

- Diversified mortgage portfolio investment opportunity

- Over twenty-five years of professional and experienced management

- Tax flow-through vehicle

- RRSP, RRIF, RESP, TFSA eligible

- Audited financial statements

*Past performance does not indicate or guarantee future results.